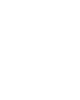

Turn Investments into

Quick Funds without

Selling in Just 24 hours

Smart liquidity when you need it,

long-term growth when you want it.

Loans starting

from ₹50,000*

Disbursal in

24 Hours

Interest-only

EMIs

App Downloads

Loan Disbursement

Partner tie-up

Optimize Your Finances Without Breaking

Your Investments

Plan your financial journey smartly with our Loan Against Mutual Funds.

Why Choose

Liquify?

Disbursement in 24 Hours

Liquify gets your approval and disburses funds within 24 hours after requesting amount withdrawal from your OD , giving you peace of mind when it matters the most.

Zero Paper Work

No more paperwork! Use your PAN and mutual fund details to apply for funds instantly on our digital platform.

Flexible Repayment Options

Pay interest only on withdrawals and repay the principal anytime complete control over your terms.

Competitive Interest Rates

Liquify offers loans at just 10.30% Per Annum, a smarter, affordable choice with low interest, flexible EMI, and financial ease.

Our Associates

Stay Updated

Explore our blog for tips and insights on mutual funds, finance, and credit—maximize investments with flexibility

You May also Like

Customer Success

Stories

Liquify has completely changed the way I look at loans.I needed funds urgently but didn’t want to sell my mutual funds. Within minutes of checking my eligibility, I was able to pledge my investments digitally, complete the KYC, and receive money in my account. The entire process was paperless, smooth, and secure. It felt like the app was built with customer comfort in mind.

I have tried a couple of finance apps before, but none of them come close to Liquify. The transparency of charges, the flexibility to repay anytime, and the fact that there are no foreclosure penalties makes it so customer-friendly. I borrowed against my MFs for my business, and the funds were in my account the same day. I now recommend this app to everyone who wants liquidity without disturbing their long-term investments.

When my family had a sudden medical emergency, Liquify was a real lifesaver. I got access to funds almost instantly, without the stress of paperwork or long waiting times. The app guided me through every step clearly, from eligibility check to disbursal, and everything was done securely. What gave me extra peace of mind was knowing that my mutual funds were safe and still growing while I managed the situation. This app gave me both financial support and confidence.

Liquify is hands down the most user-friendly finance app I have used. The design is intuitive, the process is straightforward, and even someone not very tech-savvy can navigate easily. I pledged my funds, completed KYC in minutes, and received the loan smoothly. The repayment schedule is clear, with no hidden charges or complicated terms. It felt like a financial partner, not just another app.

I borrowed ₹3 lakhs through Liquify for my home renovation, and the whole journey was seamless. The flexibility to repay in structured monthly installments made planning much easier. The biggest surprise was the transparency, APR and processing fee were shown upfront, with no hidden costs. This level of honesty is rare in financial services. Liquify has become my go-to app for instant funds.

What impressed me the most about Liquify was the flexibility. I could make part-payments whenever I wanted without any penalties, which saved me money on interest. I closed my loan earlier than planned and didn’t pay a rupee extra. No other lender has given me this freedom before. Liquify has truly set a benchmark for how modern finance apps should operate.

As an entrepreneur, I often need funds quickly for business growth, and Liquify made it possible without stress. I pledged my mutual funds and got working capital the same day, which helped me grab a new opportunity. The process was digital, clean, and transparent from start to finish. Liquify is more than just a loan app, it’s a true enabler for people like me.

The first thing I noticed was how safe Liquify felt. The app’s ID verification and security protocols reassured me at every step. I never felt like my data or money was at risk, which is very important when dealing with finance apps. On top of that, the loan journey was fast and smooth. I had funds in my account within hours. Liquify gives both peace of mind and quick liquidity.

I needed liquidity for my higher education, and Liquify was the perfect solution. The app allowed me to access funds without breaking my investments, so my mutual funds continued to grow while I managed expenses. The repayment schedule was clear, and the support team patiently guided me whenever I had doubts. It felt secure, transparent, and designed for students and families like mine.

Liquify is one of the few apps that truly puts customers first. I consolidated my debts using their loan and was impressed with how clearly everything was explained, the APR, monthly installments, and fees were all displayed upfront. The flexibility to prepay anytime without charges gave me complete control over my finances. It was not just about getting funds quickly; it was about feeling respected and valued as a customer.

Liquify has completely changed the way I look at loans.I needed funds urgently but didn’t want to sell my mutual funds. Within minutes of checking my eligibility, I was able to pledge my investments digitally, complete the KYC, and receive money in my account. The entire process was paperless, smooth, and secure. It felt like the app was built with customer comfort in mind.

I have tried a couple of finance apps before, but none of them come close to Liquify. The transparency of charges, the flexibility to repay anytime, and the fact that there are no foreclosure penalties makes it so customer-friendly. I borrowed against my MFs for my business, and the funds were in my account the same day. I now recommend this app to everyone who wants liquidity without disturbing their long-term investments.

When my family had a sudden medical emergency, Liquify was a real lifesaver. I got access to funds almost instantly, without the stress of paperwork or long waiting times. The app guided me through every step clearly, from eligibility check to disbursal, and everything was done securely. What gave me extra peace of mind was knowing that my mutual funds were safe and still growing while I managed the situation. This app gave me both financial support and confidence.